Financial data made easy cost-effective solutions for on-demand data

Flexible subscriptions helping you find the right solution: from a fully managed web offer to on-premises data solution, through API access

Overview

What is Ganymede?

Ganymede is our on-demand, fully managed data solution for asset managers, researchers, traders and data scientists.

It tackles the challenge of collecting, cleaning and normalizing tick data, intraday data, daily data, reference data, corporate actions and sustainability data whilst remaining productive and up-to-date with the best practices of data engineering.

Products

Rich data coverage with extensive range of trusted data sources and capacity of client data integration

-

Tick data

- Cost effective tick data sourcing, normalization and exploitation solution. Tick data exploitaton capabilities include intraday querying, raw provider data extractions in a normalized format, bespoke calculations and much more.

-

Reference data

- Robust cross-validation workflow with an open architecture to easily integrate new data sources. Request commonly used instrument specification codes, benefit from a unified symbology mapping and run analysis using specific provider fields.

-

Corporate actions

- Intuitive tools to collect and manage accurate market events such as splits, dividends. Integrate corporate actions data within your workflow and visualize market events coupled with other data types such as daily and intraday prices.

-

Daily data

- Scalable daily data collection and normalization with extensive connectors to trusted sources. Samples and building blocks are provided to design bespoke calculations and analytics on top of providers and exchages daily data.

-

Intraday data

- Ready to use trade minute bars : OHLCV data. Standard indicators such as SMA, MACD, RSI are provided to design bespoke calculations and analytics on top of intraday data.

-

Sustainability data

- Environmental, Social, Corporate Governance (ESG)and Controversy data. Measures companies’s exposure to ESG issues in multiple dimensions.

Data Access

Access Ganymede tick data history in a variety of easy ways

-

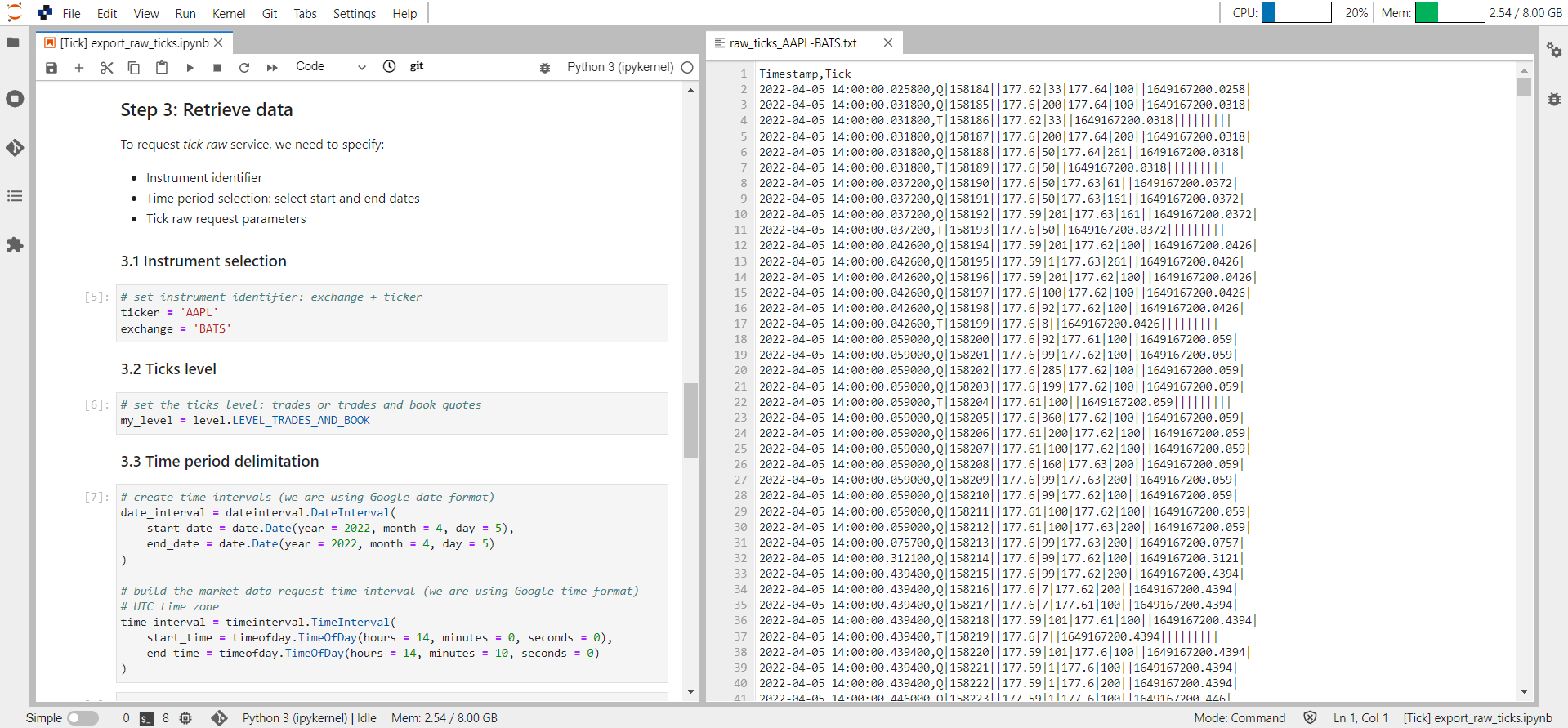

From our online portal, Jupyter Notebook, which provides easy-access tick data from any public cloud. Samples covering use cases can be found in our github repository/archive.

-

Through the Ganymede API: Clients can examine the output in the SNTR database quickly within the cloud. Ganymede API and SNTR database can be deployed in any cloud supporting Kubernetes.

-

With Ganymede files, using S3 API or optionally with SFTP. Files can be either raw tick data or processed tick data, such as 5 minute bars.

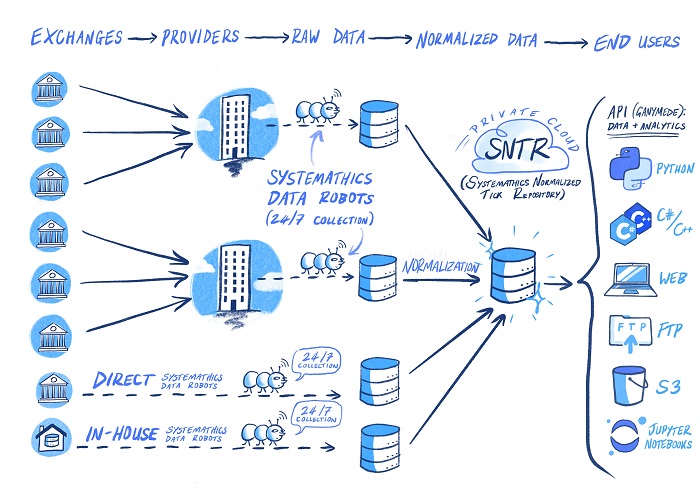

Workflow

How data is normalized and processed

- Ganymede customizable service gathers data from multiple trusted sources before cross-validating and aggregating them into a normalized database stored on a private cloud, allowing you to access the following easily and hassle-free:

- Asset classes: Forex, equities, futures, options, bonds, cryptos

- Data types: tick data, intraday data, daily data, reference data, corporate actions and sustainability data

Ganymede's solution provides you with bespoke tools to build your own custom analytics. Our services can be tailored to your needs, helping you access quality data on demand while saving valuable time.

Samples

Get a preview on how to use data with some notebook examples

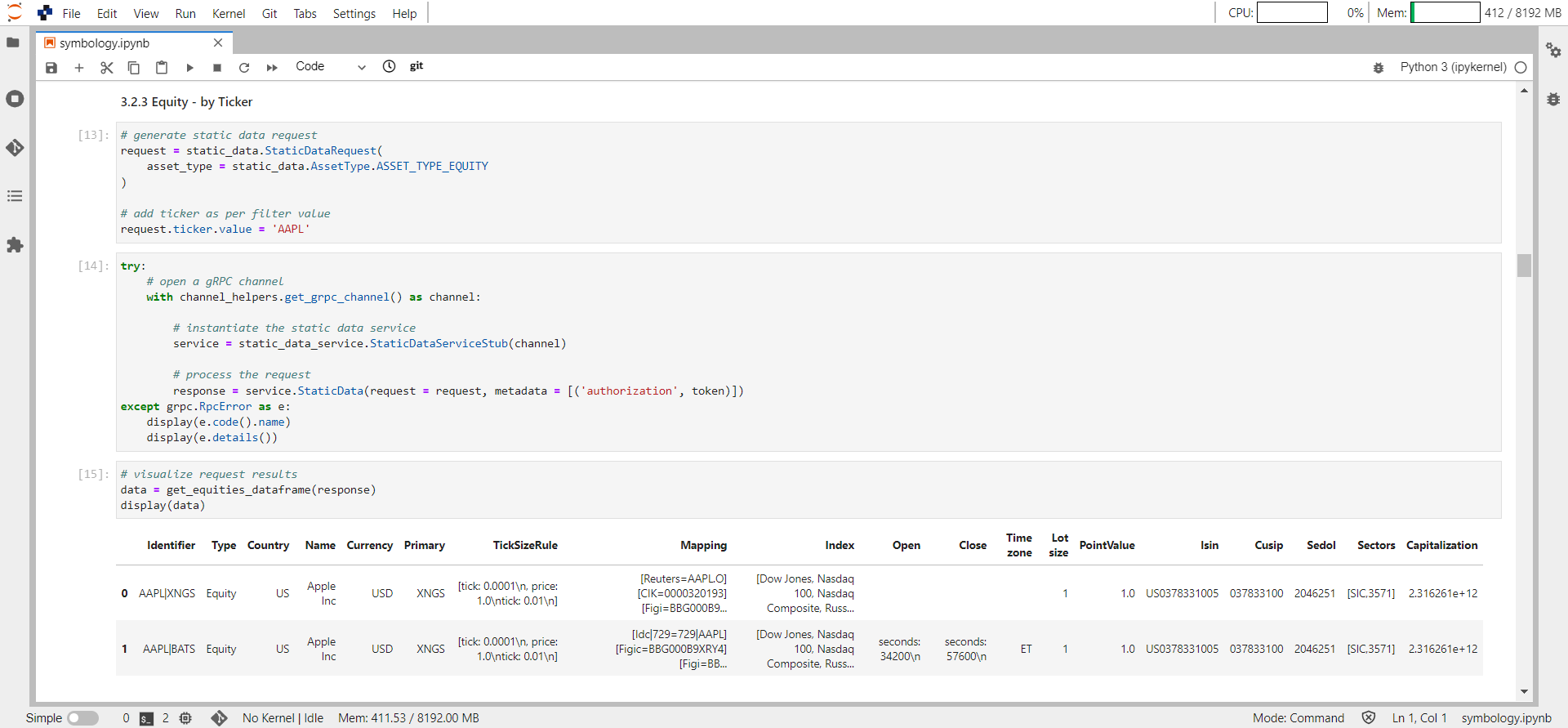

Reference and mapping data

Cross-validation process ensures quality information and completed fields, such as asset description or mappings (Bloomberg, Reuters, ISIN, SEDOL, etc.).

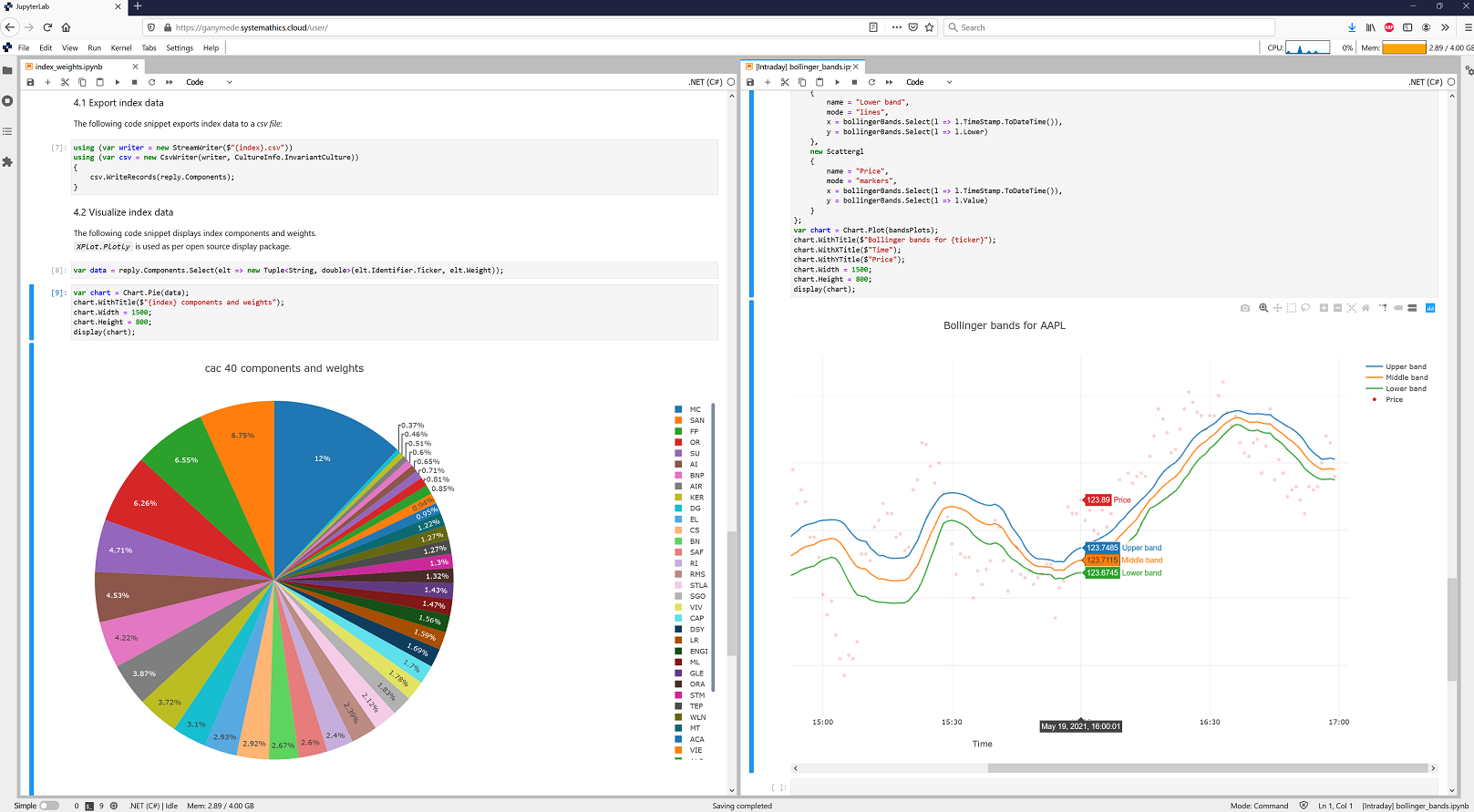

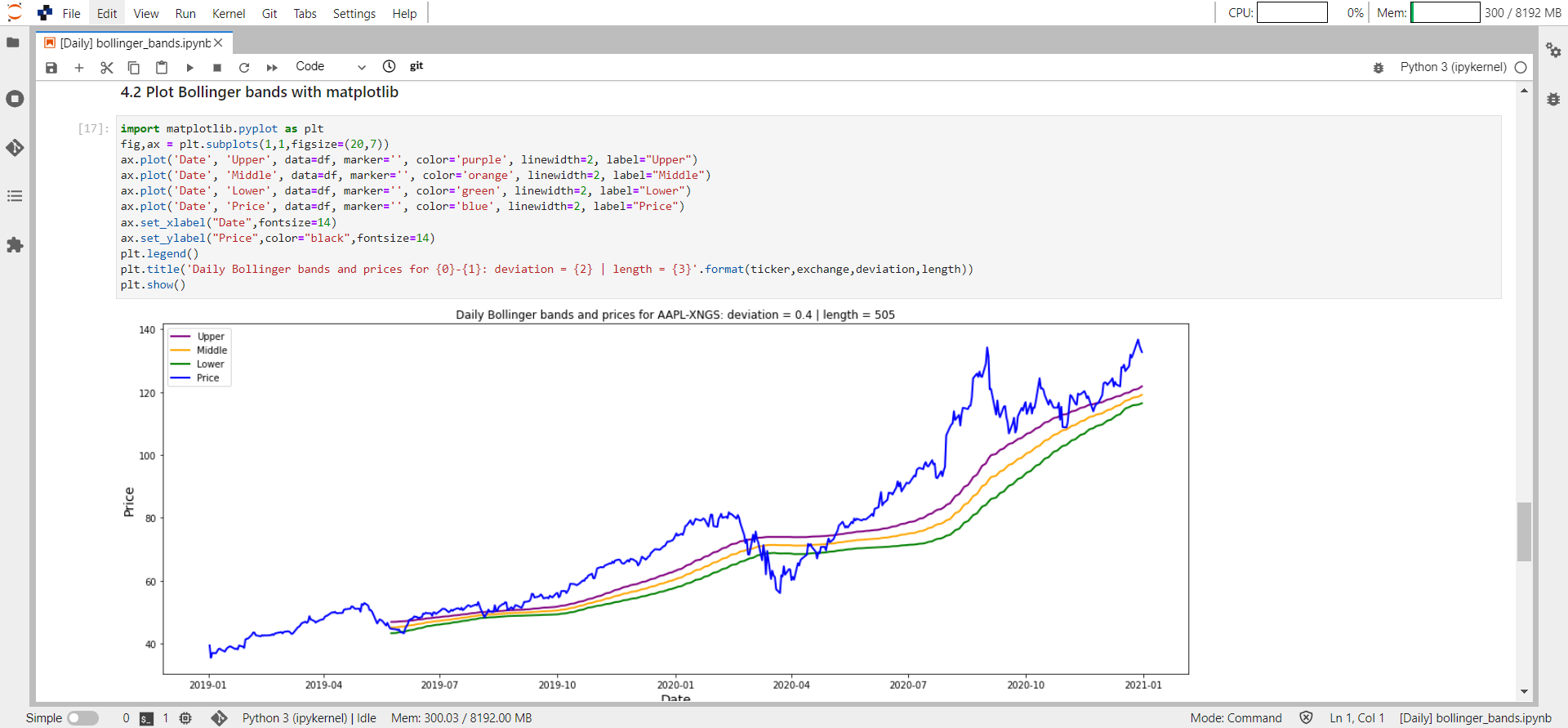

Market data analytics

On top of raw market data, Ganymede services offers ready-to-use analytics and allows you to build custom indicators.

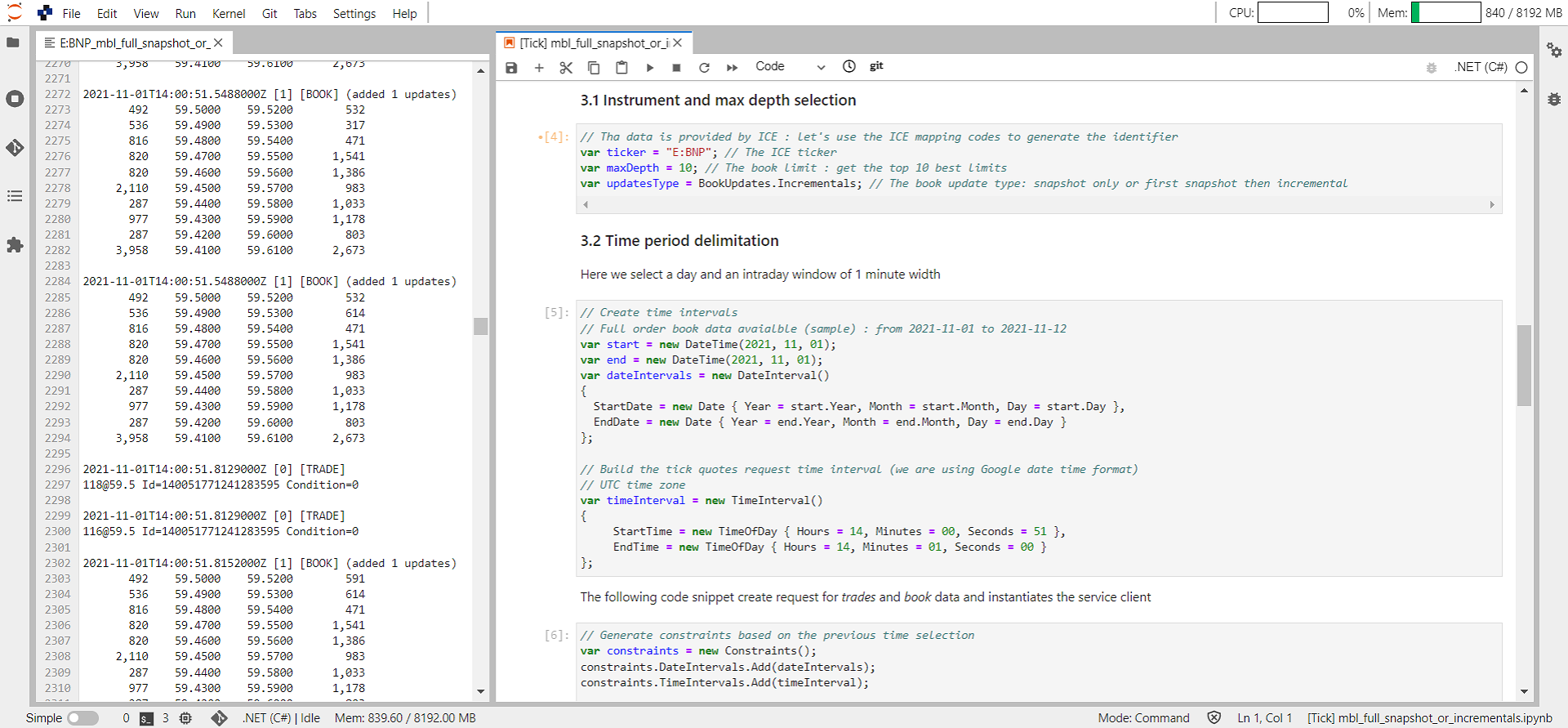

Trades and book synchronization

Synchronize level I and level II market data: trades and full order book. Reconcile and consolidate data feed to improve your back-testing experience.

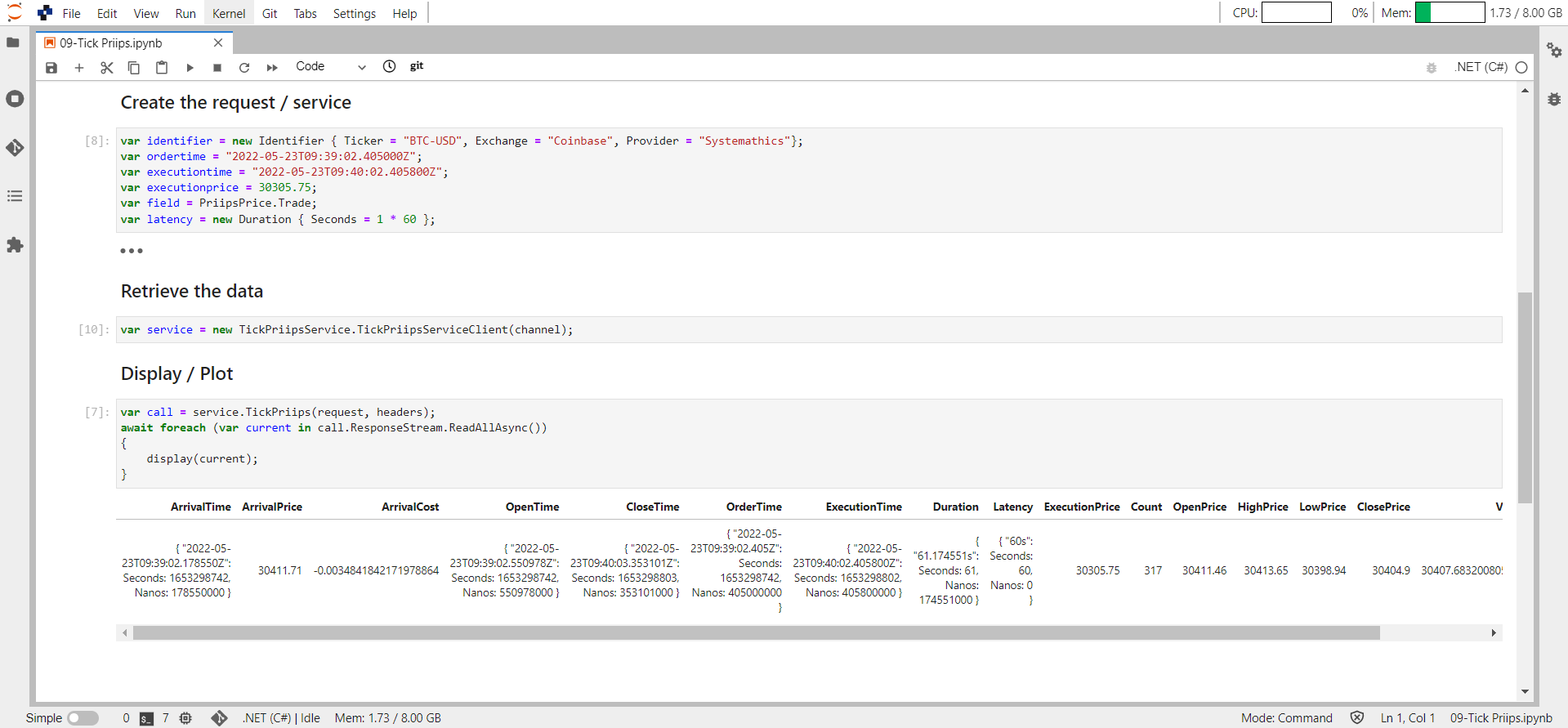

Transaction cost analysis

Meet regulatory best execution obligations and improve trading efficiency. Support of PRIIPs regulation, also known as the arrival price methodology.

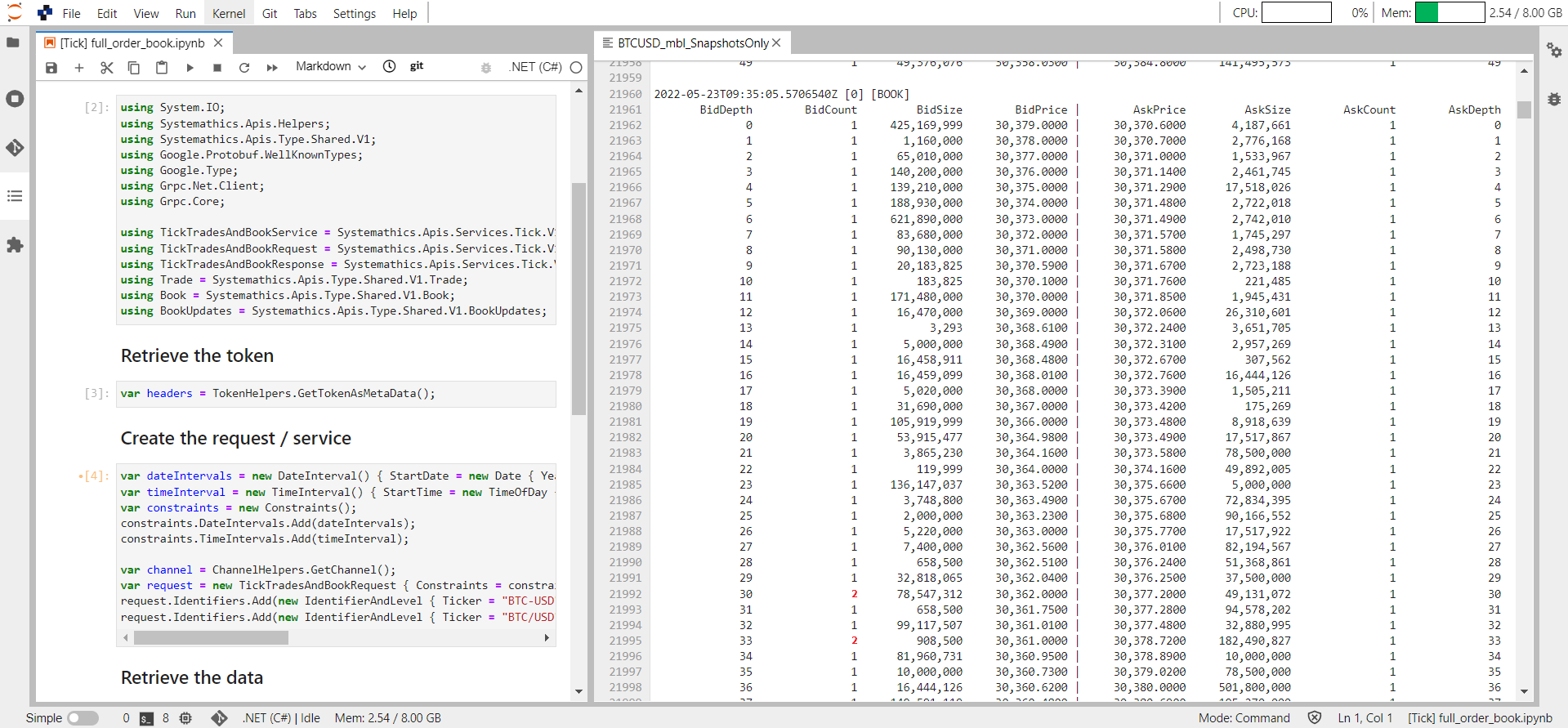

Full order book aggregation

Aggregate multiple full order books: MBO, MBL. Create the full orderbook for a specific depth.

Custom raw tick data extraction

Instantly access terabytes of raw tick data for specific assets, provided from multiple trading venues. Customize output using assets, date, or data level filters

Trade conditions filtering

Our tick data services allow trade condition filtering, enabling you to adapt your usages to each different use-case.

Use Cases

Ganymede provides help for many use cases

Mapping

Query a large database of consolidated data, with accurate static and dynamic information including symbol mappings, industry coding, historical data, corporate actions.

Backtesting

Improve your tick-by-tick data strategies performances and reliability through backtesting services.

Quantitative research

Carry out quantitative analytics.

Transaction Cost Analytics (TCA)

Meet regulatory best execution obligations through trade cost analysis in order to improve trading efficiency. Includes PRIIPs regulation, also known as the arrival price methodology.

Book reconciliation

Perform market microstructure analysis by aggregating trades and books or recreating the full order book.

Algorithmic trading

Test and develop algorithmic trading models.

Market Surveillance

Detect and avoid market manipulations and ensure your trades compliance needs through market surveillance.

Risk Management

Hedge your trading strategies and manage positions as well as their risks.

FRTB scenarios

Comply with banks Fundamental Review of the Trading Book (FRTB) with a wide historical of time-stamped tick data to match current market risk standards.